My favorite ETF reads over the past week, along with my ETF tweet and chart of the week!

Adoption of Active ETFs Is Accelerating by Todd Rosenbluth

“We expect active ETFs to remain popular in 2023.”

How to Use ETFs to Create a Fixed-Income Portfolio by Ari Weinberg

“Bond funds and ETFs offer more liquidity than most bonds beyond U.S. Treasurys.”

Crypto Chaos Dims Prospects of US Bitcoin ETF: Analysts by Ben Strack

“Can you even imagine a world where the SEC, now, says ‘Oh OK, no problem, have a bitcoin ETF?’”

Schwab Focuses on Personalization to Drive ETF Business by Heather Bell

“We think the ETF business will continue to grow – the size of traditional mutual funds and ETFs will continue to trade places.”

AllianceBernstein Plans ETF Cathie Wood Pitched a Decade Ago by Elaine Chen

“It’s such an ironic thing, because they could have been first in line.”

Morgan Stanley’s Parametric unit subadvising new Innovator ETF by Kathie O’Donnell

“Morgan Stanley, which has missed out on the first nearly 30 years of ETF asset growth, is beginning to leverage its expertise to develop a presence.”

3 Reasons ETFs Are Great Tax-Loss Harvesting Tools by Ron Delegge

“Using ETFs as replacements can go a long way toward cutting fees, reducing risk and keeping investors disciplined.”

ETF Tweet of the Week: The spectacular collapse of FTX means investors owning bitcoin via this crypto exchange are likely out of luck. Meanwhile, the Grayscale Bitcoin Trust (GBTC) is now trading at a 40%+ discount. If only there were a solution to all of this (Still. No. Spot. Bitcoin. ETF.)!

Of secondary importance here to the broader crypto market but $GBTC closed at a new record discount — just over 41%. Saw it get as deep as 42% in the last 30 minutes of trading. How deep can it go? pic.twitter.com/aULLW4B64U

— James Seyffart (@JSeyff) November 9, 2022

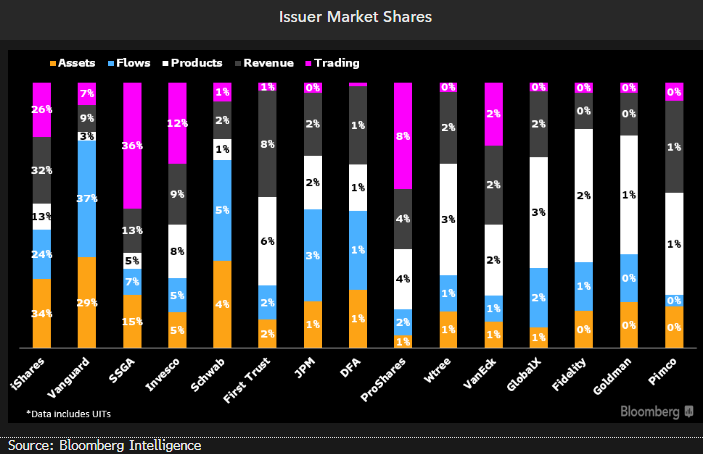

ETF Chart of the Week: As Bloomberg’s Eric Balchunas noted, “If there was a museum for ETF charts, this one should be hanging in it”. This colorful picture shows ETF issuer market share by assets, flows, products, revenue, and trading. For example, Vanguard comprises 29% of total ETF industry assets and 37% of net flows, but only accounts for 3% of products, 9% of revenue, and 7% of trading volume (remarkable numbers by the way!)…

Source: Bloomberg’s Athanasios Psarofagis

Source: Bloomberg’s Athanasios Psarofagis

Source:

Source: